(Relationships)

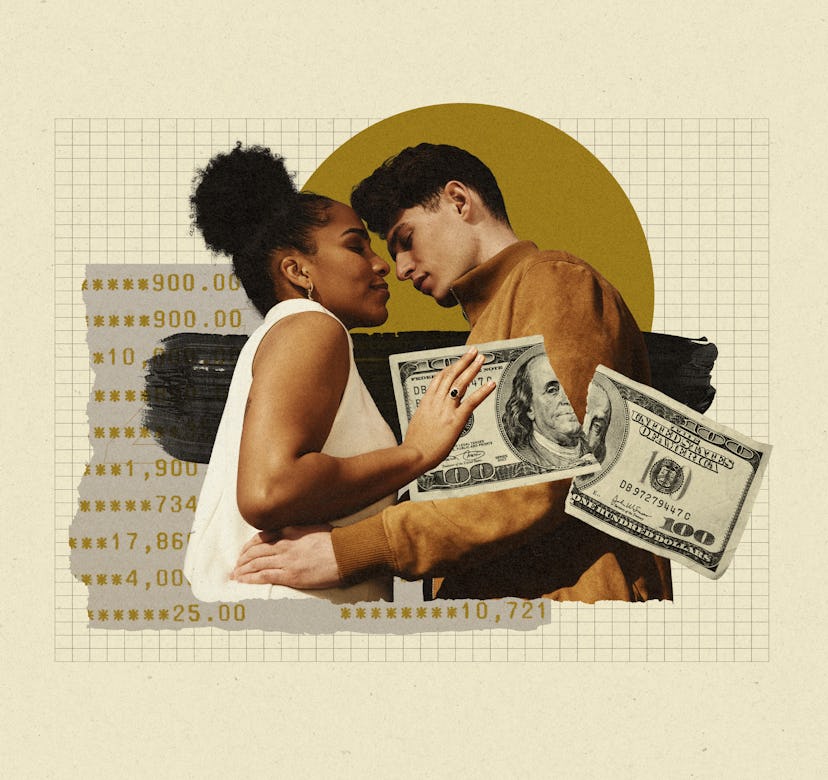

Should You & Your Partner Separate Or Merge Your Finances After Marriage?

Therapists give their honest opinions.

When it comes to finances and relationships, the topic of money has long been seen as a taboo discussion. But, it’s also one that can’t be avoided, especially if you and your significant other choose to cohabitate. As it happens, millennials seemingly grasp this concept more than previous generations. According to a recent study, 62% of millennial couples bank separately and 55% of them are putting off marriage until their finances are in order. But is there a right way to manage finances as a couple?

From a personal standpoint, my husband and I are both self-employed, so we decided to take on a hybrid method of having a joint account for all of our expenses and bills while keeping separate accounts for our businesses. We have always been open about our finances, debts, credit scores, etc. since the very beginning of our relationship, and when it came time to decide how to bank together we took this route due to the nature of our jobs.

However, in the name of research, I began asking relationship and financial experts as well as recently or almost married couples about the best way to go about setting up finances in a relationship, and was met with mixed reviews. Some couples didn't even know how much their partners had in the bank while others shared full transparency with one another. And while uncomfortable to tackle, in the end, money matters matter in relationships. Financial issues and disagreements may be the number one predictor when it comes to divorce, with over 46% of Gen-Xers stating that was their reason for separating. Further research shows that financial infidelity is also a major stressor for couples.

So, could setting up your finances in a certain way prevent divorce or breakups? Through my research, it became apparent that there are three schools of thought when it comes to relational banking: joint, hybrid, or separate. Is there a right or wrong way to bank after marriage or cohabitation? The quick answer is no. There isn’t a one size fits all solution ... but there are some key areas to consider to guide you to the best course of action.

Transparency With Finances

Therapist Elizabeth Winkler finds that finances are a major topic in her practice and are often tied to deep-rooted emotions, “As a therapist, I work with many couples considering marriage, challenged by marriage and their growing family, and I also help many end their marriages in a mindful way,” she explains. “Due to this range of experience, I have seen a variety of situations that span a variety of financial arrangements. While there are statistics to support that combining finances among couples can create a sense of union and, therefore, more likely to stay together, I am in favor of clear and mindful communication. In order for both partners to feel secure, they will need to create transparency around their finances.”

Chief People Officer and Financial Advocate at Credit Karma, Colleen McCreary, seconds this notion of transparency. “Ultimately you want to get on the same page,” she says. For some, this might mean coming up with how best to combine your finances — so doing an audit of where you both stand, what income you both have coming in and out, and then making a plan for how you want to manage your finances together. For others, this could be getting on the same page about not combining your finances and figuring out an approach that works better for you both. Be honest about your financial situation. A recent Credit Karma survey found that most millennials (78%) think open and honest communication is the key to a successful relationship — and that includes communication around money. So it might be worth finding out if your partner has the same values as you when it comes to your finances.”

Part of the transparency includes open communication around debt, credit scores, savings, and investments going into the marriage or cohabitation. Knowing where you both stand individually will help guide what directions you need to go as a unit.

Shared Financial Goals

Once transparency and communication are established, Winkler suggests identifying shared financial goals you wish to achieve as a couple. Whether it’s lowering debt, buying a house, starting a business, or going on a dream vacation, knowing where you want to go as a couple will give you a strategy for setting up your finances. Setting clear expectations with each other early on sets a precedent for a couple’s communication down the line.

McCreary likes to use this structure when advising couples about their finances.

- Find the right place and time: When it comes to sensitive topics like money, timing and location are everything. Dedicate time at a neutral location and be sure to clearly state what the discussion is about beforehand. That way your partner isn’t blindsided by a conversation they’re not prepared to have.

- Bundle the money topic into a larger conversation about your shared goals: For example, if you both wish to one day own a home, structure the conversation around the financial goal and then map out the steps you’d both need to take to get there.

- Be empathetic and adopt a team mindset: Many of us have money baggage — things like debt, low savings, and feelings of not earning enough — that we bring to relationships. Be sensitive to your partner’s experiences and thoughts, and be prepared to work toward goals together.

- Make equitable decisions: If you think money will be a problem, you could break down costs by income ratio or opt to have separate accounts. Having an agreed-upon system when it comes to your combined finances can help limit tough money conversations in the future.

- Continue the conversation: Money should never be a one-time conversation, but an ongoing dialogue between you and your partner. Find dedicated time to regularly check in on your finances together and see how you’re trending toward goals.

Pros & Cons

“Separating or joining finances can lead to tension and stress, and both can create a harmonious environment in a relationship,” shares Winkler. “The key here is that it is not a one-size-fits-all, and different professionals will have varying advice on which is best. Ultimately, the couple should discuss if a separate, joint, or a hybrid model creates the most balance, works towards shared goals, and develops a sense of security.”

She suggests the hybrid model as a “best of both worlds” compromise for couples wanting to explore merging their finances. A hybrid model could look like a shared bank account for expenses and bills with separate bank accounts for personal spending. The effectiveness of a hybrid model is additionally dependent on a couple’s financial goals, “Transparent communication is key,” reiterates Winkler. “Personally, this is my favorite choice for financial freedom as a unit and as an individual.”

I asked real-life couples to share how they managed their finances after marriage. As the experts mentioned, relational finances aren’t one size fits all and only each couple knows what works for them.

Joint

Liz and Claude decided to join bank accounts together as they see marriage as a merger in which you share everything in life. “With a good merger, you need to always be on the same page,” Liz shares. “As a businesswoman, I think prenuptial agreements should always be on the table. Trust is built and each party should execute whatever they need to feel comfortable going into a marriage and, worst case, exiting a marriage. To that, I personally believe couples should merge accounts. Partners should not have secrets, and so long as everyone feels protected, there shouldn’t be a need to have separate accounts. The only reason my husband and I didn’t sign a prenup is that we built our businesses together so everything we have is truly 50/50.”

Hybrid

Mia and Dorelle met when she was still in college and he was playing professional basketball. Over time, the couple has built businesses together so they share those professional accounts while keeping their personal accounts and Mia’s LLC separate. “My husband played professional sports for 16 years. Though I initially took on the stay-at-home mom role, as I got back into the workforce we decided to take a hybrid approach to our finances,” Mia explains. “We joined our investment, retirement and an account for all of our expenses while keeping our business accounts and personal spending accounts separate.”

Separate

Allison and Cassandra decided to keep their financials almost entirely separate. “We both own several businesses each, which complicates things including our taxes. I personally have both an S corp and an LLC and didn’t want to subject Cass to my tax liability. We also separately own homes and wanted to keep those separate as well. However, we do plan to buy a new house together at some point, and also plan to start a joint account for smaller incidentals and savings,” explains Allison.